The banking industry has witnessed a lot of change in the last few years due to the global pandemic, a series of lockdowns, the resulting supply chain crisis and economic slowdown, the Russia-Ukraine war, as well as the rise of automation and AI.

The events not only affected the way banks and financial institutions operated but also changed consumer behaviour to a great extent. As per data released by Customer Gauge, the median customer attrition rate in the industry is between 20 and 30%. Banks and financial institutions need to do whatever it takes to reduce their customer churn rate.

This is where well-designed bank loyalty programs can be extremely useful in retaining customers and minimizing customer attrition rates. Some loyalty programs that are suitable for other sectors may not be appropriate for banks and financial institutions due to regulatory, ethical, or practical reasons.

Every company that operates in the dynamic and rapidly growing industry—be it a public or a privately-owned bank, non-banking financial corporation (NBFC), or a fintech company—must leverage effective bank loyalty programs to their advantage.

What is a Bank Loyalty Program?

A bank loyalty program is a marketing strategy to encourage customer loyalty. It Offers rewards to valued customers as a way to acknowledge their ongoing business and interaction with the bank

Loyalty programs can help banks to improve customer relationships, understand customer needs, and offer personalized products and services.

Based on the information above, The rise of financial technology is putting pressure on traditional banks to innovate and improve their customer service in order to retain customers.

This blog post lists five successful examples of banks and financial institutions that are leveraging specific types of bank loyalty programs to reward their customers. Read on and thank us later.

Top 5 Examples of Bank Loyalty Programs

1. Bank of America’s ‘Preferred Rewards program

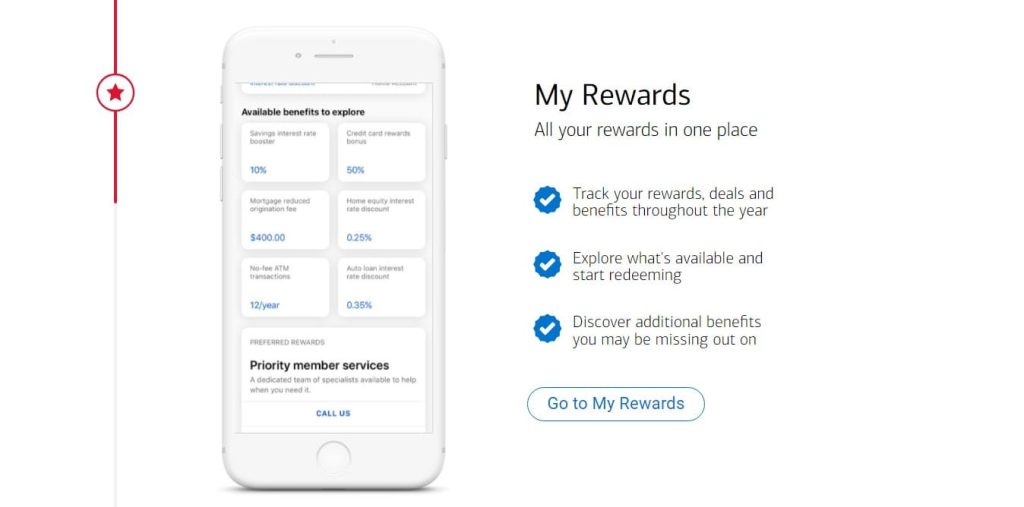

Founded in San Francisco in 1998, Bank of America serves more than 66 million customers in over 4,300 branches across the U.S. The lender has a loyalty program christened ‘Preferred Rewards,’ which has three levels and members get attractive rewards as they climb their way up through the tiers.

The base tier is the ‘Gold level,’ which requires customers to maintain a minimum three-month combined average daily balance of $20,000 across their Bank of America and Merrill accounts. Members of this tier get a five % interest rate booster, a 25% bonus on eligible priority credit services, and many more rewards and valuable benefits that enhance their banking experience.

The second tier, ‘Platinum level,’ unlocks even more benefits for customers who maintain a minimum three-month combined average daily balance of $50,000. Members of this tier enjoy a significantly increased value in all benefits available at the Gold level. They get higher credit service bonuses and interest rate boosts.

The third tier, ‘Platinum Honors level,’ provides the most exceptional rewards and benefits to customers who maintain a minimum three-month combined average daily balance of over $100,000. Members of this tier receive all the benefits of the Gold and Platinum levels but with even more attractive deals.

Bank of America’s Premium Rewards provides its members with enhanced rewards and travel benefits in exchange for an annual fee of $95. The minimum credit limit for the loyalty program is $5,000 and some members have received higher credit limits to the tune of $50,000. The program offers a sign-up bonus of 60,000 online points (worth $600) after a member spends a minimum of $4,000 in the first 90 days of account opening.

2. Citibank’s Citi ThankYou Rewards

Citibank, which was founded as the City Bank of New York in 1812 and later renamed as First National City Bank of Europe, is one of the largest international financial services companies in the world. The bank has more than 100 million customers and 2,649 branches in 98 countries. In 2019, the bank registered revenue of USD 74 billion.

The financial firm has an extremely popular points-based loyalty program named ‘Citi Thank You Rewards,’ which enables members to earn points through a wide range of ways. Members can earn points for banking with Citi using an enrolled checking account, using a Citi credit card, and adding qualifying services and products to an existing Citi checking account. Examples include Home Equity Line/Loan, Mortgage, Auto Save, or Personal Loan.

The value of a Citi Thank You point can vary significantly depending on how you redeem it. Members can redeem ThankYou points for travel, cash back, gift cards, charity, payment towards a mortgage or student loan, or shopping.

The best thing about Citi ThankYou Rewards is the level of flexibility and freedom it offers customers in choosing how to use their points. The points can also be shared with other members of the loyalty program.

3. JP Morgan’s One Card

When it comes to banking loyalty programs how can the largest American bank by assets be left behind? New York-headquartered JP Morgan also has a points-based bank loyalty rewards program named ‘One Card.’

In the program, every reward point is equal to a dollar spent. The program requires customers to use a JP Morgan card to collect points and use it in a wide range of ways such as gift cards, travel cards, cash credit, and merchandise.

The loyalty program also provides big businesses with the option to reward their employees with points as well as reinvest the points into the business. Members can earn unlimited points and the points are extremely easy to manage and don’t expire.

The best part is, that members get 25,000 bonus points if they spend at least $50,000 within three months of account opening. The loyalty program is designed to minimize the risk of misuse of points and fraud. Real-time reporting makes it extremely easy to keep track of the points.

4. Wells Fargo Rewards

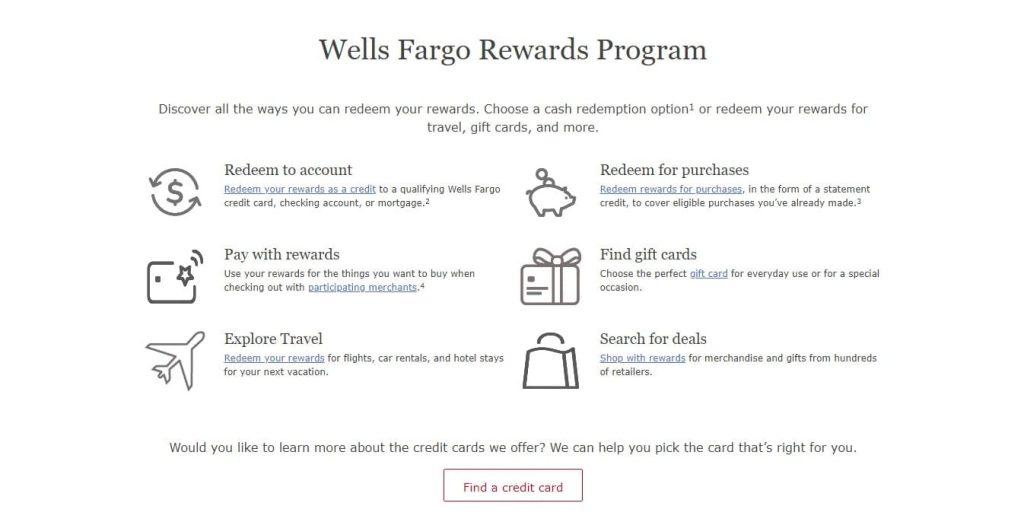

San Francisco-based Wells Fargo is one of the leading banks in the U.S. with a customer base of 70 million, a market share of USD 97 billion, and a total asset of USD 1.97 trillion. The bank’s loyalty program is named ‘Wells Fargo Rewards,’ which is available to all eligible rewards-based credit card holders.

The financial service company offers three eligible credit cards—the Wells Fargo Active Cash Card, the Wells Fargo Reflect Card, and the Hotels.com Rewards Visa Credit Card.

Customers who have enrolled in one of these special credit cards get a chance to win a wide range of rewards such as:

- redeeming for purchases and gift cards

- redeeming rewards back to their accounts

- using the rewards towards airline and holiday expenditures

Customers can share the rewards with a fellow Wells Fargo account holder or donate the points to the American Red Cross. The reward program is easy to manage. Customers can keep track of their rewards through the Wells Fargo website.

5. Capital One Venture Rewards

Capital One, which was founded in 1994 in Richmond, Virginia, is a bank that’s known for specializing in savings accounts, credit cards, and car financing options. The bank offers accounts for individuals and businesses and it enables parents to open savings accounts for their children with no minimum balance requirements or monthly fees.

The bank offers an exciting loyalty program named ‘Capital One Venture Rewards,’ which is a three-tiered loyalty program that offers a wide array of benefits and perks for its credit card users. The tiers are:

General rewards: Customers with a credit card and an account are eligible for this tier. Rewards in this tier include cash back on entertainment, dining, grocery stores, and other purchases.

Travel rewards: Customers who have the Capital One Venture/Venture One travel rewards card are eligible for this tier. The tier offers excellent miles rewards to customers with strong credit for an annual fee of $95. By using the loyalty card, members can earn two miles on every dollar they spend on all purchases. They get a sign-up bonus of 75,000 miles when they spend at least $4,000 in the first three months of account opening.

Cash back rewards: Customers who have the Quicksilver credit card are eligible for this tier. Rewards for this category include cash back on every purchase, which can be redeemed in any way the customer likes.

To sum it all up,

As the name indicates, bank loyalty programs are specially designed for banks and financial institutions. That makes the loyalty programs extremely suitable in all aspects. These four types of bank loyalty programs will not only help banks and financial institutions retain customers for a long time but also build trust and strengthen customer relationships.

At LoyaltyXpert, we have a solid track record and years of experience when it comes to creating successful loyalty programs. If you are looking for a loyalty solution partner that will not just help you design and run effective bank loyalty programs but stand firmly by your side throughout each stage, then look no further. Contact us today to book a free demo and experience how we can help you realize your dreams.