How important are loyalty programs for financial service providers? Let’s take a look at the findings of various studies. One research conducted by Collinson Group reported that seven out of every ten customers who participated in the study said rewards from financial institutions influence their decisions.

Another study by KPMG found that three out of every five customers said that banks and financial institutions must come up with innovative ways to reward loyal customers.

Financial loyalty programs play a huge role in retaining customers and reducing customer churn rates in financial institutions. Speaking of churn rate, the median customer attrition rate in financial services businesses is between 20 and 30%, as per Customer Gauge data.

This blog discusses some key aspects of financial loyalty programs and lists the five best loyalty programs around the world. If you are looking to launch a financial loyalty program and gain some deeper insights into it, this is for you. Read on and thank us later.

Key Rewards in Financial Loyalty Programs

Over the years, financial loyalty programs have evolved a lot. Many banks and financial institutions use traditional rewards such as offers, cash backs, and other rewards. But many corporations have started using the following:

-

Tiered membership programs

This is one of the most used reward strategies in financial loyalty programs. In it, customers are placed on specific tiers based on their bank balance or credit card purchases.

-

Reward sharing

Many successful financial corporations allow reward sharing. This involves sharing loyalty points and rewards with other members or charities.

-

Digital wallets

Makes it easier for customers to store their loyalty cards, reward coupons, and event passes, which can be used for easy enrollment and reward redemption.

-

Exclusive clubs

Premium customers and big spenders are made members of exclusive clubs, which bestow a wide range of special privileges and benefits upon them.

-

Extra bonuses

Many financial reward programs provide extra bonuses to customers if they manage to make a specific amount of credit card purchases in a certain period. Some also provide bonuses if customers’ bank balances reach a certain amount.

?Also Read: Bank Loyalty Program: Top 5 Successful Examples

5 Examples of Best Financial Services Loyalty Programs Globally

Some financial services companies have extremely successful financial loyalty programs compared to their competitors. Even though there are many such examples around the world, we have handpicked five extremely popular financial loyalty programs.

1. JP Morgan’s “One Card”

JPMorgan, one of the oldest financial institutions in the U.S. and the largest bank by total assets, launched its “One Card” loyalty program in 2009.

The points-based financial loyalty program encourages customers to use the One Card to earn loyalty points. Each loyalty point is equal to a dollar spent and the number of points a customer can collect is unlimited. The points don’t expire and are extremely easy to manage.

The loyalty program is fortified with real-time reporting, which not only makes it easy to track the points but also decreases the risk of misuse of points as well as loyalty fraud.

Customers can use the points in several ways, such as:

- Gift cards

- Cash Credit

- Travel coupons

- Merchandise

The program also provides a lot of benefits, such as extra bonuses. Customers can receive 25,000 bonus points if they manage to spend USD 50,000 within three months of opening their accounts.

2. Citibank’s “Citi ThankYou”

New York-based multinational financial services provider Citibank also launched its “Citi ThankYou” loyalty program in 2009.

Like JP Morgan’s One Card, Citi ThankYou is a points-based loyalty program, which enables customers to earn points through various ways, such as:

- Using a Citi credit card

- Banking with Citi using an enrolled checking account

- Adding qualifying services and products to an existing Citi checking account

A Citi credit card is needed to enrol in the program, after which customers earn one point for every dollar spent using the card.

Customers can buy 1,000 points for USD 25. They can transfer the earned points to the account of another member.

Customers can use the points for cash rewards, gift cards, travel rewards, charity donations, and to pay back mortgage or student loans.

3. Capital One Rewards

Virginia-based bank holding company Capital One has a reward scheme, which is a three-tiered program:

General Rewards: This tier offers rewards to customers who have a credit card. The rewards range from cash back on dining, grocery purchases, entertainment, and more such purchases.

Travel Rewards: This tier offers rewards to customers who have Capital One Venture or Venture One travel rewards cards.

Cash Back Rewards: This tier is reserved for customers who have the Quicksilver credit card. Rewards include cash back on every purchase, which customers can redeem as per their preference.

The holding bank also has a loyalty program named “Purchase Eraser,” which enables its customers to make travel-related purchases with their rewards card. The purchases are wiped out from their statement as per the earned miles.

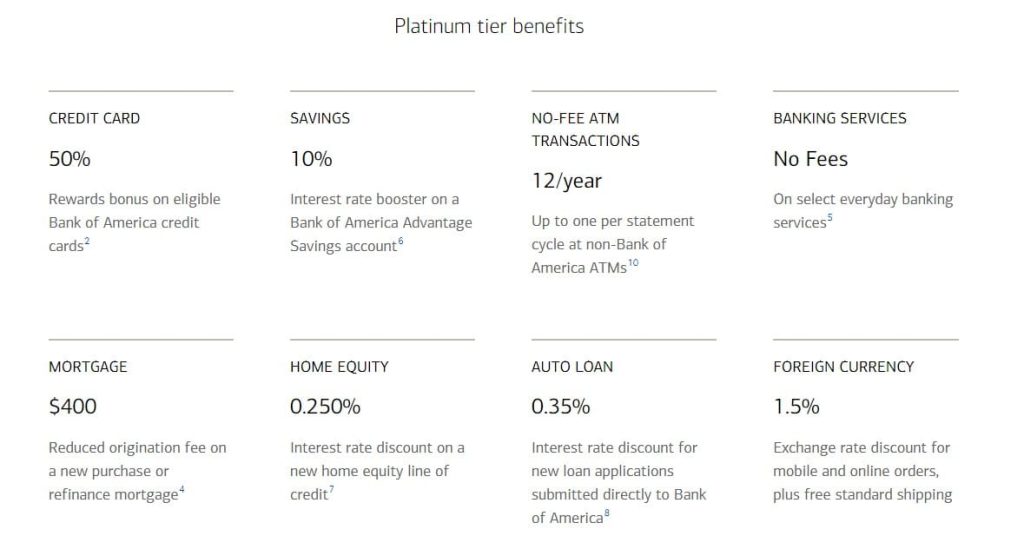

4. Bank of America’s Preferred Rewards

North Carolina-based multinational investment bank and financial services holding company Bank of America’s financial loyalty program is named “Preferred Rewards.”

It is a three-tiered loyalty program designed to reward customers based on the amount of money they have in their bank accounts. The tiers are:

- Gold: Customers with a combined balance of USD 20,000 to USD 50,000

- Platinum: Customers with a combined balance of USD 50,000 to USD 100,000

- Platinum Honors: Customers with a combined balance of USD 100,000 to USD 1 million

Apart from being rewarded for the amount of money customers have in their bank accounts, they will also be rewarded in the form of discounts for certain products and services.

5. Wells Fargo Rewards

San Francisco-headquartered multinational financial services company Wells Fargo has a reward-based credit card system that’s available to all eligible reward-based credit card holders. The financial services company offers three eligible credit cards—the Wells Fargo Active Cash Card, the Wells Fargo Reflect Card, and the Hotels.com Rewards Visa Credit Card.

Each card has a different reward system and benefits. Customers who have enrolled in one of these special credit cards get an opportunity to win a wide range of attractive rewards, such as:

- Redeeming for purchases and gift cards

- Redeeming rewards back to their accounts

- Using the rewards towards airline and holiday expenditures

Customers can share the rewards with a fellow Wells Fargo account holder or donate the points to the American Red Cross.

The reward program is easy to manage. Customers can keep track of their rewards through the Wells Fargo website.

Taking everything into account

Customer retention and loyalty are one of the biggest challenges in the banking and financial services industries. That’s why financial loyalty programs are extremely crucial for banks and financial corporations to reduce customer attrition rates and retain their customers for a long time.

At LoyaltyXpert, we have years of experience in designing and creating high-quality and sophisticated loyalty programs for many banking and financial corporations. If you’re interested to know how our financial loyalty programs can benefit your business, contact us today to book a free demo.